Statistically speaking, drivers have a road accident every 7 years. This is therefore a situation in which you rarely find yourself and in which the parties involved in the accident usually don't really know what to do. Here we provide tips for cases where the parties involved in the accident are partially at fault. Because you can save a lot of money with the right settlement procedure.

Partial fault in the event of a no-fault accident - it is essential to clarify the question of fault

A road accident is very annoying, regardless of whether it involves major damage or a minor scratch. The accident not only involves damage that needs to be repaired, but also a lot of paperwork that needs to be dealt with. Before a claim can be settled, the question of fault must first be clarified. Depending on who or how much is at fault for the traffic accident, the Motor vehicle liability insurance or comprehensive insurance on.

In order to be able to assert claims for damages, it is therefore very important to clarify who is the injured party and who caused the road accident. The question of fault is determined based on the circumstances of the accident. If you report your traffic accident via the fairforce.one portal, you will receive an initial assessment of the question of fault from our network of highly qualified traffic lawyers within 24 hours. And best of all, there are no costs involved. So you can find out quickly and free of charge whether you can make a claim for a partially at-fault accident.

Accident victims like you get the best support from fairforce.one.

Have your accident reported now free of charge and without obligation by our regulation specialists.

This is the right approach in the event of a partial debt accident

Accidents with partial fault are often - incorrectly - settled as follows: If each of the parties involved in an accident bears some of the blame, each must also compensate for part of the damage. Your own motor vehicle liability insurance pays for the other party's damage. How much the insurance covers depends on the percentage of fault. If the apportionment of fault is 50 %, the liability insurance will reimburse 50 % of the costs incurred by the other party. Despite comprehensive insurance, the parties involved are often left with the rest.

Take advantage of the right of first refusal. Instead of bluntly sending everything directly to the other party's liability insurance, settle the claim using your own comprehensive insurance. This means that you get off much better if you settle your claim primarily via your comprehensive insurance and get the rest from the other party's liability insurance.

Combine cleverly and save a lot of money

Two drivers have an accident and are partly to blame for 50 %. The repair costs of car 1 are €1,000 and those of car 2 are €15,000. According to the usual settlement method, the liability insurance of driver 2 would therefore pay driver 1 €500. The liability insurance of driver 1, on the other hand, pays €7,500 to driver 2. Both drivers are now stuck with 50 % of the costs incurred.

Many people wrongly assume that the rest is to be settled via the fully comprehensive insurance. Comprehensive insurance does cover the repair costs, but does not pay for claims such as depreciation, hire cars or experts.

It is therefore better to settle your claim primarily via the fully comprehensive insurance and recover the rest via the other party's liability insurance.

Sample calculation

Motorist 50 % Partial debt, €300 excess with fully comprehensive insurance

| Repair |

2.000€ |

|---|---|

| Towing |

250€ |

| Impairment |

200€ |

| Appraiser |

500€ |

| Loss of use |

300€ |

| Flat-rate costs |

30€ |

| Total |

3.280€ |

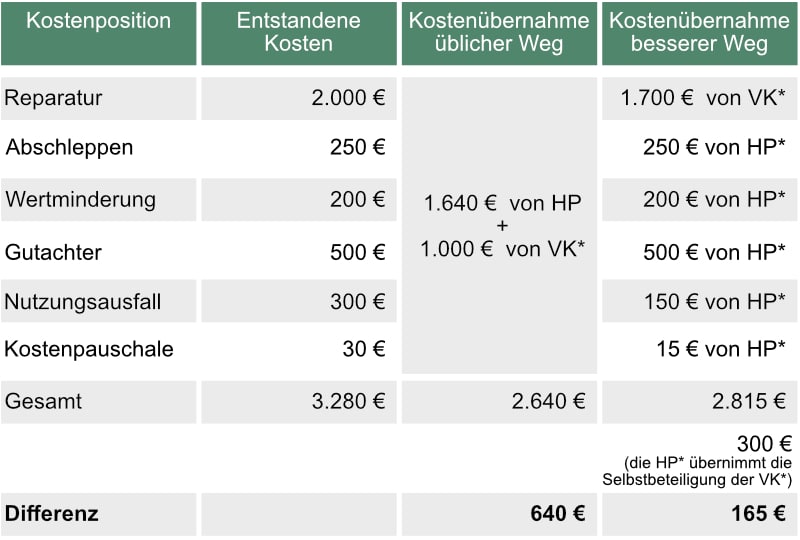

Usual procedure: The driver opts for the opposing insurance company to pay 50 % of the costs - in this case €1,640. The driver would like to get the rest from the fully comprehensive insurance. As fully comprehensive insurance only covers the repair costs, the driver would receive €1,000 from his fully comprehensive insurance. He would then receive €2,640 from both insurances together. This means that he is left with € 640.

The much better way: The driver first contacts the fully comprehensive insurance company. This not only covers half of the damage, but the full repair costs - i.e. €2,000. After deducting an excess of €300, the driver receives €1,700 from their fully comprehensive insurance. In the next step, the driver goes to the other party's liability insurer to claim the remaining damage. The liability insurer covers the remaining items, and not only on a pro rata basis, but for some cost items even up to 100 %.

| Cost item | Costs incurred | Cost absorption usual way | Better way to cover costs |

|---|---|---|---|

| Repair | 2.000 € | 1,640 € from HP + 1,000 € from VK* |

1,700 € from VK* |

| Towing | 250 € | 250 € from HP* | |

| Impairment | 200 € | 200 € from HP* | |

| Appraiser | 500 € | 500 € from HP* | |

| Loss of use | 300 € | 150 € from HP* | |

| Flat-rate costs | 30 € | 15 € from HP* | |

| Total | 3.280 € | 2.640 € | 2.815 € 300 € excess (The HP* covers the deductible of the UK*) |

| Difference | - | 640 € | 165 € |

*VK = own fully comprehensive insurance, *HP = liability insurance of the other party involved in the accident

The example clearly shows that the driver has to pay €640 themselves if they follow the usual procedure. If the damage is initially settled via comprehensive insurance and the rest is paid via the opposing party's liability insurance, only €165 would have to be paid out of pocket in this case.

Drivers should therefore memorise the sequence accident (partial fault) - fully comprehensive insurance - opposing insurance.

The right steps for fair claims settlement

Do you want to know whether it is worth using your fully comprehensive insurance? Do you want to know whether the partial debt will result in an insurance upgrade?

Then play it safe and contact us directly:

- Our competent team of experts will discuss with you the right course of action for you.

- If required, we can organise an expert to come to your home. He will prepare the valuable independent expert report

- Your complete claims are calculated and requested by specialised teams of lawyers using our software.

- If required, our network of tested, reliable specialist workshops and replacement vehicles will support you.

- You will be kept up to date on all regulatory progress via our innovative HIS (customer information system).

We can't undo your accident. But we will make the best of it for you, we promise!

FAQ on regulation for partial debt

What does fully comprehensive insurance pay in the event of a no-fault accident?

Comprehensive insurance usually covers the full repair costs in the event of an accident with partial fault and only claims the agreed excess. In the case of a completely no-fault accident, it is not involved at all, as the other party's insurance is responsible for settling the claim.

learn moreWho decides on partial debt?

Who is responsible for what percentage of the accident is determined on the basis of the circumstances of the accident, for example by an expert.

learn moreHow much does fully comprehensive insurance increase in the event of damage?

This depends on the damage, the accident and the settled costs. It is best to enquire with your insurance company or contact us to find out as little upgrading as possible. We will help you to ensure that you do not suffer any disadvantages.

learn more